Business Insurance in and around Bellevue

Get your Bellevue business covered, right here!

Insure your business, intentionally

- Omaha

- Papillion

- Elkhorn

- Gretna

- Sarpy County

- Douglas County

- Saunders County

- Wahoo

- Millard

- Omaha Metro Area

State Farm Understands Small Businesses.

When you're a business owner, there's so much to remember. We get it. State Farm agent Rob Timm is a business owner, too. Let Rob Timm help you make sure that your business is properly protected. You won't regret it!

Get your Bellevue business covered, right here!

Insure your business, intentionally

Customizable Coverage For Your Business

For your small business, whether it's a funeral home, an ice cream shop, a toy store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, equipment breakdown, and accounts receivable.

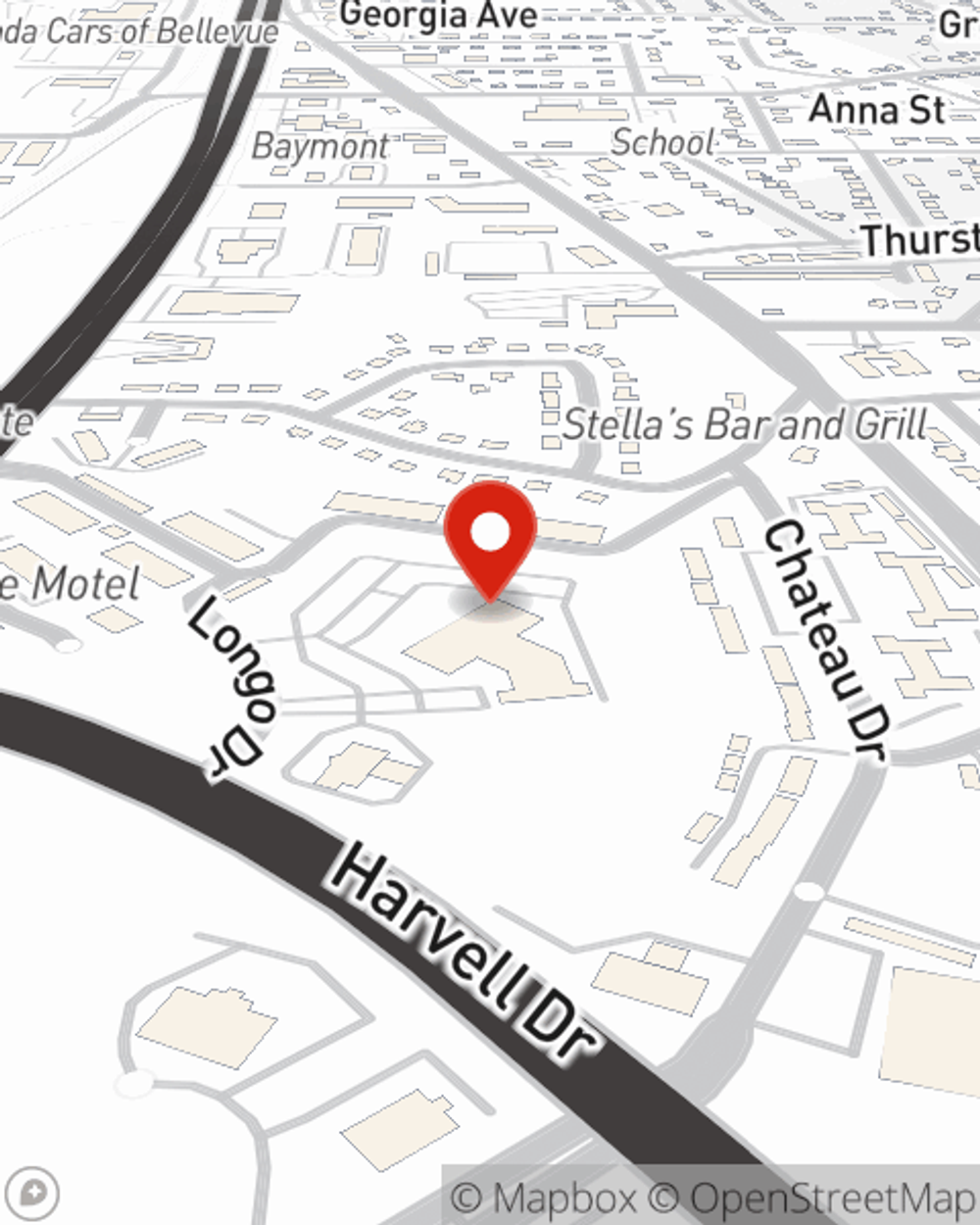

Visit State Farm agent Rob Timm today to learn more about how one of the leaders in small business insurance can ease your business worries here in Bellevue, NE.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Rob Timm

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.